Introduction to Environmental

Accounting

By Rabiu Aminu, PhD, FCNA, FMNES

Environmental accounting also referred to as Green Accounting is a field that identifies resource use, measures and communicates costs of a company’s or national economic impact on the environment. It is a subset of accounting, its target being to incorporate both economic and environmental information. It is a means of integrating environmental considerations into financial decision-making. Therefore, environmental accounting is a vital tool to assist in the management of environmental and operational costs of natural resources.

Environmental accounting is the

practice of incorporating principles of environmental management and

conservation into reporting practices and cost/benefit analyses. It includes

the processing of both financial and nonfinancial information regarding

environmental and ecological impacts.

One of the key principles of

environmental accounting is the concept of "true cost accounting."

This approach involves accounting for all costs associated with a product or

service, including those that are typically externalized, such as pollution or

resource depletion. An environmental accounting system consists of

environmentally differentiated conventional accounting and ecological

accounting. Environmentally differentiated accounting measures effects of the

natural environment on a company in monetary terms.

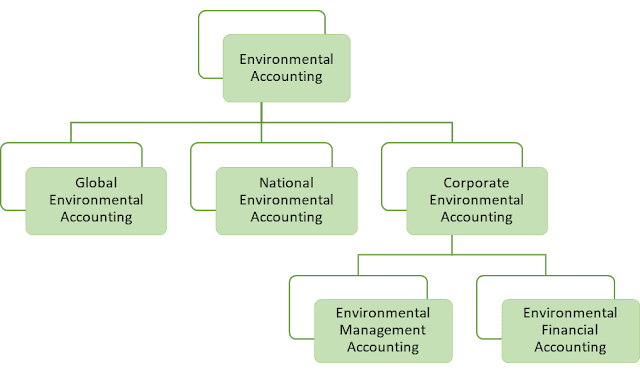

Classifications of Environmental Accounting

Environmental accounting is

organized in three sub-disciplines: global, national, and corporate

environmental accounting, respectively. Corporate environmental accounting can

be further sub-divided into environmental management accounting and

environmental financial accounting.

The diagram below shows the classifications of environmental accounting.

|

| Classifications of Environmental Accounting |

Global Environmental Accounting

Global environmental accounting

is an accounting methodology that deals with energetics, ecology and economics

at a worldwide level. It is a statistical framework that provides a systematic

approach to organizing and analysing environmental and economic data to answer

policy and other questions. The System of Environmental-Economic Accounting

(SEEA) is a framework that integrates economic and environmental data to

provide a more comprehensive and multipurpose view of the interrelationships.

National Environmental Accounting

National environmental accounting

is an accounting approach that deals with economics on a country’s level. It is

a branch of accounting dealing with activities, methods, recordings, analysis,

and reporting of environmental and ecological impacts of defined economic

systems. Internationally, environmental accounting has been formalized into the

System of Integrated Environmental and Economic Accounting, known as SEEA. SEEA

grows out of the System of National Accounts.

Corporate Environmental Accounting

Corporate environmental

accounting focuses on the cost structure and environmental performance of a

company. It is a field that identifies resource use, measures and communicates

costs of a company’s or national economic impact on the environment. Costs

include costs to clean up or remediate contaminated sites, environmental fines,

penalties and taxes, purchase of pollution prevention technologies and waste

management costs.

Corporate environmental

accounting can be further sub-divided into environmental management accounting

and environmental financial accounting.

Environmental Management Accounting

Environmental management

accounting (EMA) is the identification, collection, analysis and use of two

types of information for internal decision making. The first is physical

information on the use, flows and rates of energy, water and materials

(including wastes). The second is monetary information on environment-related

costs, earnings and savings. EMA focuses on making internal business strategy

decisions. EMA is an attempt to integrate best management accounting thinking

and practice with best environmental management thinking and practice.

Environmental Financial Accounting

Environmental financial

accounting is used to provide information needed by external stakeholders on a

company’s financial performance. This type of accounting allows companies to

prepare financial reports for investors, lenders and other interested parties.

References

Abe, M.

(2015). Environmental accounting: Meaning, classifications and importance. Journal

of Environmental Science and Management, 18(2), 27-40.

Antwi, S. K.,

& Osae-Kwapong, I. (2019). Environmental accounting and reporting: A review

of literature. Journal of Environmental and Occupational Science, 8(2),

81-89.

Ayadi, F.

(2017). The role of environmental accounting in sustainable development. Journal

of Economic and Social Development, 4(1), 56-64.

Burritt, R.,

& Schaltegger, S. (2010). Sustainability accounting and reporting: fad or

trend? Accounting, Auditing & Accountability Journal, 23(7), 829-846

Gari, A.,

& Hamzaoui, M. (2016). Environmental accounting: An overview of concepts

and classifications. International Journal of Economics and Management

Engineering, 10(4), 1073-1079.

Hidano, N.,

& Kurisu, K. (2018). Environmental management accounting for decision

making: An empirical study in Japan. Journal of Cleaner Production, 197,

1015-1023.

Joshi, S.,

& Keshari, A. (2020). Environmental accounting: Concept, need and

challenges. International Journal of Research in Commerce and Management,

11(1), 1-6.

Ministry of

Environment (2019). Environmental accounting: A tool for sustainable

development. Retrieved from https://www.env.go.jp/en/earth/ea/intro.html

Schaltegger,

S., & Burritt, R. (2000). Contemporary environmental accounting: issues,

concepts and practice. Sheffield Academic Press.

United

Nations Statistics Division (2019). System of Environmental-Economic

Accounting 2012: Experimental Ecosystem Accounting. Retrieved from https://unstats.un.org/unsd/envaccounting/seeaRev/seeaFlyer.aspx

No comments:

Post a Comment